DeFiML Crypto Hedge Fund – Unlocking Alpha with AI

Unlock Alpha with the AI-Powered DeFiML Crypto Hedge Fund. Leveraging proprietary AI and machine learning to generate superior risk-adjusted returns in the decentralized finance ecosystem.

The Opportunity – Why DeFi and Why Now?

DeFi is revolutionizing finance with open, borderless solutions. Now is the time to seize the opportunity.

The DeFi Market Is Exploding

Crypto moves fast, and DeFi is leading the charge. Traditional finance is slow, expensive, and controlled by big players. DeFi flips the script. It gives anyone access to powerful financial tools—lending, borrowing, trading—without banks or middlemen. And it’s growing like crazy.

The Big Opportunity

The DeFi market has skyrocketed, unlocking massive opportunities. Billions are flowing into the space, and the potential for growth is off the charts. But there’s a problem.

The Challenges

DeFi is exciting, but it’s not easy. Prices swing wildly. Scams and hacks happen. And if you don’t know what you’re doing, you can lose money fast.

Most investors don’t have the time or skills to navigate this complex world. That’s where we come in.

The Solution

We use AI to cut through the noise. Our smart algorithms analyze data, spot trends, and make better decisions, faster. Instead of guessing, we let AI handle the heavy lifting—finding opportunities, managing risks, and keeping your investments safe. That means more potential gains with fewer sleepless nights.

Introducing the DeFiML Alpha Fund – Your Smart Crypto Hedge Fund

The crypto market moves fast, and so do we. The DeFiML Alpha Fund is built to help investors stay ahead by using AI-powered strategies to find the best opportunities, manage risk, and maximize returns.

Fund at a Glance

- Fund Name: DeFiML Alpha Fund

- Goal: Use AI to deliver high returns while managing risk

How We Do It

✅ AI-Driven Opportunity Identification

AI scans the market in real time, finding the best DeFi opportunities before they go mainstream.

✅ Dynamic Portfolio Allocation

We don’t stick to a rigid strategy. AI adjusts asset allocation based on market trends to optimize gains.

✅ Strategic DeFi Engagement

We maximize earnings by leveraging staking, yield farming, and lending—without unnecessary risks.

✅ Robust Risk Management

AI constantly monitors investments, protecting against market swings, hacks, and security threats.

Ready to learn more?

This fund takes the complexity out of DeFi, making it smarter, safer, and more profitable for investors.

The Power of AI – Our Crypto Hedge Fund Competitive Edge

Crypto moves fast. AI moves faster. That’s why we use AI-driven strategies to stay ahead of the market, eliminate guesswork, and make smarter investment decisions.

✅ Data-Driven Insights

Markets change in seconds. AI scans massive amounts of data to spot trends before they happen.

✅ Automated Execution

No emotions. No hesitation. AI follows a strategy and executes trades at the right time, every time.

✅ Enhanced Risk Management

AI constantly watches for unusual activity, helping prevent losses before they happen.

✅ Adaptability

Markets shift. AI reacts instantly, adjusting strategies to keep returns high and risks low.

Explore AlphaPulse by DeFiML

AlphaPulse is powered by DeFiML, a leading platform in decentralized finance and machine learning solutions. We combine advanced AI algorithms with comprehensive market data to provide you with actionable insights for your crypto investments.

Join our growing community of over 1,000+ traders using AlphaPulse for real-time market insights, portfolio risk analysis, and advanced trading signals.

Strategic Asset Allocation – Designed for Optimal Returns

The key to strong returns is balance. Our portfolio is designed to capture the best opportunities in DeFi while managing risk. Here’s how we break it down:

40%

Core Foundation

We start with solid, established DeFi projects that have strong fundamentals. This gives us stability in the portfolio.

30%

AI-Driven Tactical

AI takes over from here, making dynamic investments based on real-time signals. This allows us to take advantage of shifting market conditions.

20%

DeFi Innovation

We invest in high-growth DeFi projects with strong potential, giving us access to the next big opportunities in the market.

10%

Cash/Stablecoins

We always keep some liquidity on hand for quick market opportunities and to reduce risk during volatile times.

Ready to take part?

This strategy gives us a smart balance: solid foundations, real-time AI moves, high-growth bets, and enough liquidity to stay flexible. It’s all about maximizing returns while keeping risk in check.

Robust Risk Management – Protecting Your Investment

Investing in crypto comes with risks, but we’re committed to protecting your capital. Our approach to risk management uses smart strategies and the power of AI to keep your investments safe.

Key Risk Management Strategies

✅ Diversification

We spread investments across multiple assets to reduce risk. This way, no single move can hurt the overall portfolio.

✅ AI-Powered Market Monitoring

AI constantly monitors the market in real-time, spotting anomalies before they become a problem.

✅ Stop-Loss Protocols

We set up automated stop-losses to protect against big losses, ensuring your investments stay safe even in volatile times.

✅ Smart Contract Audits

Before we engage with any DeFi projects, we run thorough audits to make sure smart contracts are secure and free of vulnerabilities.

With these strategies in place, you can invest with confidence, knowing we’re protecting your capital every step of the way. Ready to secure your future with us? Let’s talk.

Meet the Experienced Team – Expertise You Can Trust

Volant Digital LTD, a leader in software, AI, finance, blockchain, and crypto trading, manages the DeFiML Alpha Fund. Our team brings years of hands-on experience to ensure your investment is in safe, capable hands.

Our Team’s Expertise

We’re not just a group of finance professionals. Our team blends expertise from AI, blockchain, and crypto trading to create a powerful, forward-thinking investment approach.

We’ve worked in some of the most advanced areas of tech and finance. We understand the markets, and we use cutting-edge tools to stay ahead.

When you invest with us, you’re backed by a team that’s committed to your success.

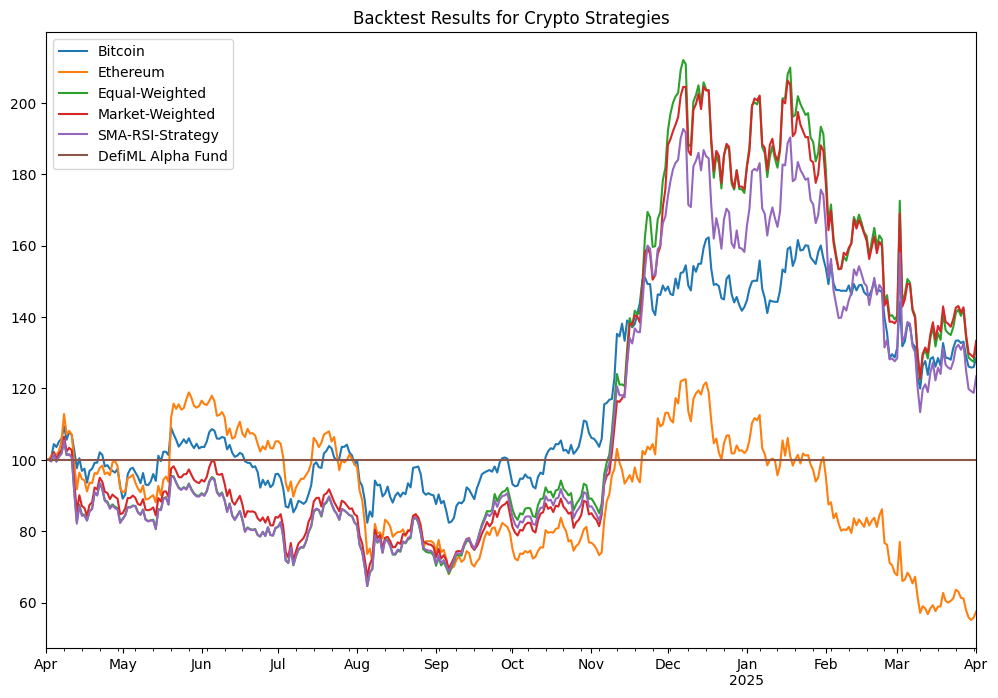

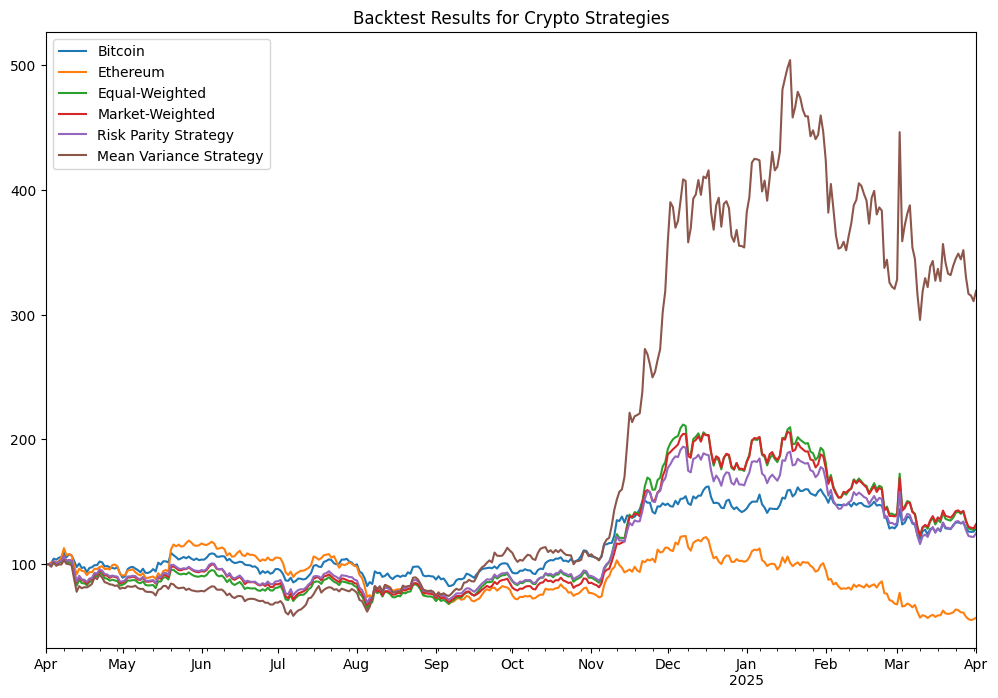

Combined Strategy Performance

DeFiML Alpha Fund tracks the best-performing strategies shown above.

First, we looked at how several crypto strategies performed in two different backtests. You can see the performance of each strategy in both backtesting scenarios in 1 year.

Disclaimer: Past performance does not guarantee future results.

This strategy’s performance can be verified using the CryptoTradeMate open-source backtesting tool.

Strategy 1 Performance

Bitcoin: +30%

Ethereum: -40%

Equal-Weighted: +35%

Market-Weighted: +40%

SMA-RSI: +30%

DeFiML Alpha Fund: +40%

Strategy 2 Performance

Bitcoin: +30%

Ethereum: -40%

Mean Variance: +230%

Market-Weighted: +60%

Risk Parity: +40%

DeFiML Alpha Fund: +230%

The DeFiML Blockchain Project – Building the Future of Decentralization

At DeFiML, we’re passionate about revolutionizing decentralized finance (DeFi) by integrating advanced AI technology with blockchain solutions. Our mission is to create a more transparent, efficient, and accessible DeFi ecosystem for everyone.

Our Vision

We aim to develop blockchain solutions that enhance transparency and efficiency in DeFi markets. By combining AI with blockchain, we provide smarter financial tools and safer transactions, making DeFi more user-friendly and secure.

Crypto Hedge Fund Synergy

Our crypto hedge fund gains exclusive access to proprietary blockchain data from the DeFiML project. This unique advantage allows us to make informed investment decisions, optimize strategies, and deliver better returns for our investors.

Development Status

We’re actively developing the DeFiML blockchain project. Our comprehensive whitepaper outlines our technology, use cases, and roadmap. We invite you to explore it to understand our approach and future plans.

Join us in shaping the future of decentralized finance

By integrating AI with blockchain, we’re not just following trends—we’re setting them.

Frequently Asked Questions About Crypto Hedge Fund

We know you probably have questions, and we’re here to help. Below are answers to some of the most common questions investors ask about the DeFiML Alpha Fund and crypto hedge funds in general.

What is the minimum investment amount?

The minimum investment amount is $25,000. Please contact our team for details on current requirements.

What are the fees associated with investing?

Our fund operates on a performance-based fee structure, ensuring our interests align with yours. We charge a 1.5% annual management fee to handle your portfolio and a 20% performance fee on profits. So, we only succeed when you succeed.

Is there a lock-up period?

Yes, some investments may require a 1 year lock-up period to maximize returns and reduce unnecessary market exposure. Contact us for details on withdrawal terms.

How is AI used in portfolio management?

AI helps us analyze market trends, spot opportunities, and adjust our strategy in real time. This gives us an edge in making smarter, data-driven investment decisions.

How can I monitor my investment?

We provide a secure investor dashboard where you can track your portfolio, performance, and key metrics in real-time.

What is a hedge in crypto?

A hedge is a strategy to reduce risk. In crypto, this could mean diversifying assets, using derivatives, or holding stablecoins to protect against volatility.

Which country is best for a crypto hedge fund?

Countries like Switzerland, Singapore, the Cayman Islands, and the U.S. offer crypto-friendly regulations and strong financial infrastructure. The best location depends on legal factors, tax benefits, and investor preferences.

Is hedging allowed in crypto?

Yes, hedging is widely used in crypto. Traders and funds hedge their positions using options, futures, and algorithmic strategies to manage risk.

What do hedge funds do?

Hedge funds pool investor capital and use advanced strategies to maximize returns. Crypto hedge funds apply similar principles but focus on digital assets like Bitcoin, Ethereum, and DeFi investments.

Ready to Take the Next Step?

Discover how the DeFiML Crypto Hedge Fund can help you maximize returns with AI-powered strategies. Request an Investor Information Pack today!