This blog explores how to analyze DeFi projects with artificial intelligence (AI) and machine learning (ML) techniques to automate and enhance DeFi investment processes.

In the rapidly evolving world of decentralized finance (DeFi), identifying winning projects early can mean the difference between massive returns and costly mistakes.

However, with thousands of projects launching every year, manual analysis is no longer enough.

This is where artificial intelligence (AI) comes into play.

Today, learning how to analyze DeFi projects with AI is a must for serious crypto investors and hedge fund managers.

So, in this guide, we’ll break down exactly how AI can transform your DeFi investment strategy, practical tools you can use, and tips to stay ahead of the competition.

Let’s jump right in…

You may also like:

- 5 Best Alternatives to Multicoin Capital

- 5 Best Crypto Signals for Hedge Funds

- How Machine Learning is Changing Crypto Trading

- 5 Best AI-Powered Crypto Trading Tools

Why AI is Changing How We Analyze DeFi Projects

In DeFi, knowing which project to invest in can make or break your portfolio. But the old way of doing research? It’s slow and hard to keep up with.

You read long whitepapers, dive deep into tokenomics, scan community channels, and check smart contract audits. That’s a lot of work — and it’s easy to miss things or get caught up in hype.

AI is changing that.

With AI, you don’t need to spend hours on research. It can scan and analyze hundreds of DeFi projects in minutes.

Neither does it get tired. Nor does it get emotional. It simply identifies patterns, data, and trends that most people overlook.

Here’s why that matters:

- Speed: AI can process massive amounts of DeFi data in no time.

- Accuracy: It removes human emotion and bias from the decision-making process.

- Insight: It spots smart contract patterns and wallet behavior that people can’t see.

- Prediction: It can forecast risk, growth, and market trends based on real-time data.

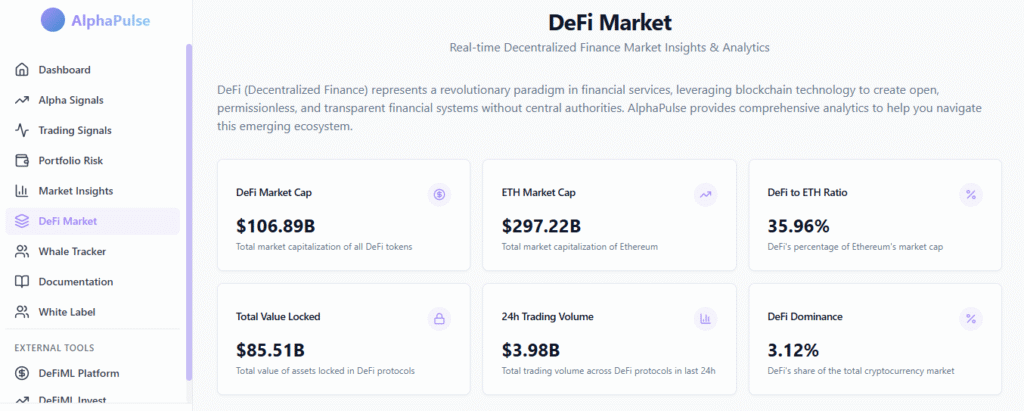

Imagine you’re using DeFiML’s AlphaPulse. With AlphaPulse, all that AI power is turned into simple, smart scores. This tool ranks DeFi projects based on risk, potential adoption, and long-term strength.

So instead of guessing, you’re using data — and that gives you a real edge.

AI doesn’t just make DeFi research faster. It makes it smarter. potential, and sustainability — giving hedge funds a clear data advantage.

Key AI Metrics to Analyze DeFi Projects

If you’re using AI to help you spot strong DeFi projects, you’ll want to know what it’s looking at.

AI doesn’t just grab random data — it focuses on clear, useful signals that show how real and healthy a project is.

Here are the key areas where AI tools shine:

On-Chain Activity

This is where the action happens.

AI looks at things like wallet growth, how many people are making transactions, where the liquidity is moving, and how users are staking their tokens.

- Why it matters: If real people are using the project, not just bots or hype, that’s a good sign.

Smart Contract Health

Smart contracts run the show in DeFi.

AI scans these contracts for bugs, red flags, or anything that seems off. It can catch risky code or unusual activity before something breaks.

- Why it matters: You want to know if your money is sitting in a safe protocol, not one that might get hacked.

Tokenomics Modeling

AI can test different “what-if” scenarios for a token’s supply.

Will more tokens flood the market soon? Will inflation hurt the price? Or is the supply shrinking, which could drive prices up?

- Why it matters: AI helps predict how a token’s design might affect its future price.

Community Sentiment

People talk. A lot.

AI listens. It scans thousands of tweets, Reddit threads, Telegram chats, and news posts to see how the community really feels.

- Why it matters: A strong, active community usually means the project has support and staying power.

Developer Activity

No one wants to invest in an abandoned project.

AI tracks GitHub and other dev platforms to see how often the team updates the code and how committed they are.

- Why it matters: More updates usually mean the team is still building — and that’s a good sign.

Example:

AlphaPulse pulls all this into one clean score called AlphaScore. It shows you — in one number — how strong a project is based on all the things above.

No guessing. Just solid signals.

AI gives you the kind of edge you can’t get scrolling through social media or reading a dozen whitepapers. It’s fast, smart, and focused on what matters.

Smart Ways to Use AI for DeFi Research

AI is a powerful tool when you’re looking into DeFi projects. It can save time, cut through noise, and spot things you might miss.

But just like any tool, it works best when used the right way.

Here are a few tips to help you get the most out of it:

Don’t Trust Just One Metric

AI gives you a lot of data. That’s great. But don’t make a decision based on just one number.

A project might show strong volume, but the smart contracts could be poorly written. Or it might have good community buzz, but the token supply is about to inflate like crazy.

- What to do: Check multiple signals — like user activity, tokenomics, code updates, and contract safety — before making a move.

Use Real-Time Alerts

Things in DeFi change fast. A project can look great in the morning and fall apart by night.

Good AI tools let you set alerts. You’ll know right away if there’s a big token dump, a sudden whale exit, or a change in project control.

- What to do: Use tools like AlphaPulse to set custom alerts for things like governance shifts or wallet activity spikes.

Backtest Before You Buy

Some AI platforms let you run historical tests on a strategy. You can see how a project would have performed in the past if you’d followed certain signals.

It’s not a guarantee of the future, but it gives you a clue.

- What to do: Backtest your strategy with different metrics to see what might have worked. It’s one of the safest ways to learn without losing money.

Don’t Skip Human Thinking

AI is smart, but it’s not perfect. Sometimes it misses context. Or it doesn’t see upcoming events that humans are talking about.

That’s why you should never invest based on AI alone.

- What to do: Use AI to narrow your choices. Then dig in yourself. Check community vibe, read recent updates, and use your gut too.

Make Sure the Data’s Fresh

Old data is useless in DeFi. Things move by the hour.

If your AI tool is pulling outdated numbers, you’re flying blind. Make sure it’s getting real-time or very recent updates.

- What to do: Stick with tools that clearly show when their data was last refreshed, like AlphaPulse, which updates live from on-chain and off-chain sources.

Final Tip:

Think of AI as your co-pilot. It handles the heavy lifting, but you’re still the one flying the ship.

Combine its speed and insight with your research, and you’ll make sharper, safer calls in DeFi.

4 Best AI Tools to Analyze DeFi Projects

If you want to invest smart in DeFi, you need good tools. The space moves fast, and digging through charts and code isn’t always enough. That’s where AI comes in.

AI tools help you cut through noise, spot hidden trends, and get clear signals without spending hours researching.

The good news? There are now some great platforms built just for this.

Here are some of the best ones to check out:

1. DeFiML’s AlphaPulse

If you’re looking for deep insight, AlphaPulse is one of the strongest tools out there. It’s built for hedge funds, pro traders, and serious DeFi investors — but it’s simple enough for beginners, too.

It gives each project an AlphaScore — a smart rating that shows risk, growth potential, and how active the community and devs are. It pulls live data from across the chain, then turns it into a single, easy-to-understand number.

- Why it’s great: You don’t have to guess. You just check the score, compare projects, and make smarter calls.

2. IntoTheBlock

This tool focuses on on-chain data and uses AI to predict what might happen next. It looks at things like large holder activity, transaction patterns, and inflows/outflows.

- Why it’s great: If you want to know what big wallets are doing, this tool helps you follow the money.

3. Token Terminal

Think of this like Bloomberg for DeFi. It uses AI to give financial-style metrics for crypto projects.

You can check things like revenue, earnings, and even P/E ratios, like you would for stocks.

- Why it’s great: It helps you treat DeFi like a real business, not just hype.

4. Nansen

Nansen is great for tracking wallet behavior. It labels wallets using AI, so you can see what “smart money” is doing.

Are the whales buying? Are top funds moving into a token? You’ll know.

- Why it’s great: You can spot trends before the crowd and ride the wave early.

Pro Tip

Want one tool that combines on-chain, off-chain, sentiment, and predictive AI?

Go with DeFiML AlphaPulse. It saves time, cuts confusion, and helps you make clearer investment choices in 2025 and beyond.

Whether you’re managing a fund or just starting, it gives you the edge you need, without drowning in data.

Conclusion: AI Will Define the Next Wave of DeFi Winners

As DeFi becomes more crowded and competitive, learning how to analyze DeFi projects with AI will separate the best investors from the rest.

Instead of getting overwhelmed by information overload, AI can help you filter noise, spot hidden gems, and protect yourself from bad actors.

At DeFiML, we’re building the future of DeFi investing by combining AI precision with human expertise.

Ready to level up your DeFi investments?

👉 Start using AlphaPulse by DeFiML today and get a data-driven edge over the market!

FAQs: How to Analyze DeFi Projects with AI

Thinking about using AI to study DeFi projects?

You’re not alone. A lot of investors are turning to AI tools to help them make faster, smarter moves.

If you’re new to this, these common questions will help you get started.

What’s the best way to analyze DeFi projects with AI?

The best way is to look at both what’s happening on-chain and off-chain.

Use AI to track wallet growth, transaction volume, and liquidity. Then combine that with sentiment from social media, forums, and news.

Tip: Tools like AlphaPulse do all this for you in one place.

Can AI tell me which DeFi projects will take off?

AI can’t see the future — but it can get you close.

It spots early signs of growth, big money movements, and patterns most people miss.

That gives you a better chance of picking winners before the crowd sees them.

Is using AI for DeFi expensive?

Nope. You don’t need a hedge fund budget.

Platforms like AlphaPulse offer simple plans for individual users. You get the same powerful insights without breaking the bank.

What should I look at when analyzing a project?

Here’s a quick list:

- Wallet activity

- Smart contract safety

- Token supply and inflation

- Community engagement

- Developer updates

These signals tell you how real and healthy the project is.

What makes DeFiML different from other tools?

AlphaPulse by DeFiML takes all the important data — both on-chain and off-chain — and turns it into a simple score.

So instead of drowning in charts and reports, you get a clear snapshot of risk, strength, and potential in seconds.

Still unsure? Just try a free version of a tool like AlphaPulse. It’ll make researching DeFi feel a lot less confusing — and a lot more fun.